How do you improve your credit score in 30days? I did not think that was possible until I experienced it myself.

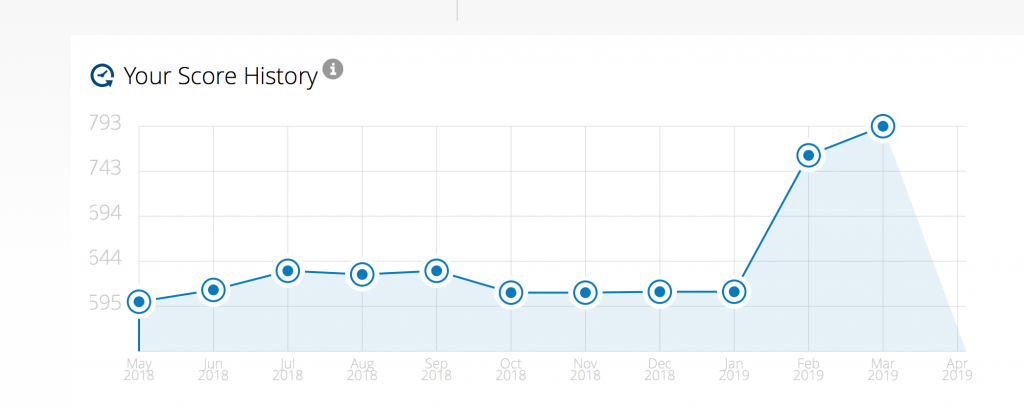

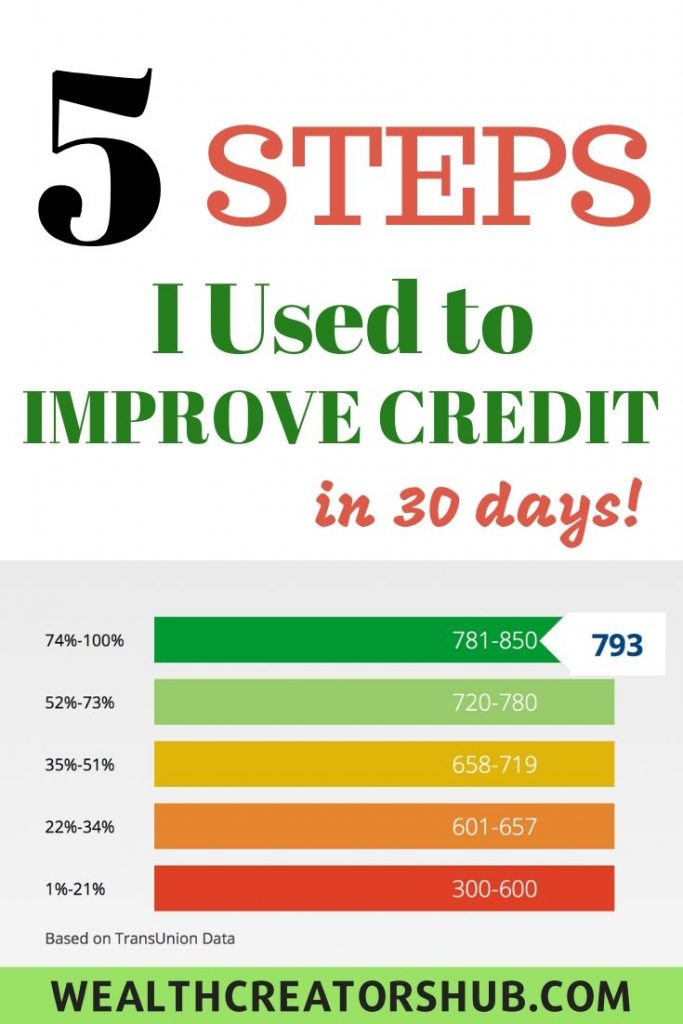

I am sharing the steps that helped improve my credit score from 595 to over 743 in 30 days after a foreclosure! And how I continued to raise my credit score to 793 by the next month and beyond. I hope you find one or two helpful nuggets to help you achieve your credit increase goals as well.

Set A Debt Payoff Goal

One of the things that greatly helped improve my credit score was setting goals, with deadlines for reaching those goals. You probably have heard of SMART goals, what this simply means is you want to set goals that will work for YOU! When it comes to setting goals for your personal life, not one size fits all!

For your goals to be attainable, make sure that are SMART:

- Specific: What is your goal? What are you setting off to achieve? What will you do?

- Measurable: How much debt do you want to pay off?

- Attainable/Achievable: Is this goal reasonable considering your current situation?

- Relevant: Is it going to fulfill the purpose why you set the goals in the first place? Will it positively impact your immediate and future goals?

- Timely: Have you set your deadline? By when will you have achieved this goal? Set a specific date.

First, I used a spreadsheet to analyze what my different credit card debts were, who I was owing and how much owed to each company.

Make A Debt Payoff Plan

Next, I found an app for planning. Simply search the app store on your phone, and check the reviews and number of downloads to ensure you won’t be wasting your time downloading it. Otherwise, you can install it and test it out. If it doesn’t work, uninstall, and look for a better one.

I found one that worked for me from the google play store. It’s called “Debt Payoff Planner“. It’s a FREE app and it worked well for me. I was able to add my different debts, set a deadline and it helped me calculate what I need to pay every time depending on my set schedule (monthly, biweekly… you get it). It also factored in the APRs, so that was really helpful for me.

I also have a FREE Debt PayOff Planner Pack available for download. It’s part of my “IF YOU BELIEVE YOU CAN, YOU WILL” Bundle. If you will like to have the FREE printables, click here.

Stopped Using The Cards

Since I was looking to pay off the credit cards, I stopped using the cards. In fact, I left them in a safe, that way I don’t have them when I go out and cannot be tempted to use them.

Became An Authorized User

I discussed this and other helpful ways to improve your credit score in my prior post. In my case, I was added to my husband’s credit card, and as we continued to be current on his card, my credit started to improve.

Paid Off Credit Cards In Full

Because I enjoyed the comfort of seeing substantial funds in my account, I only paid a little over the minimum on my credit cards every month.

However, I realized this was costing me more than the “interest” I was making on the savings account. As a matter of fact, I earned just a few cents on the “savings account”, but paid high dollar amounts in interest charges on my credit cards.

So I had to analyze what I had saved, what I could afford to use towards the credit card, and what I needed for my emergency funds. It is important to not use ALL of your available cash to pay off your credit because that may lead you back to worse debt if you have an emergency.

With the help of the FREE app – “Debt Payoff Planner” mentioned above, I planned my debt payoff goals. Seeing the debt decrease with each payment was very thrilling and motivating, starting first with the smallest debt paid off, and then moved on to the next one.

I saw the big jump when I eventually used a chunk of my savings to pay off the rest of the debt., as you’ll see in the screenshot below. Besides, it was so fulfilling and so relieving to see the debts go to zero.

Few Things I Learned NOT TO DO In The Process

After becoming an authorized user I started to see my credit score rise slightly. I got so excited, I decided to close some credit cards – A WRONG MOVE! This actually caused a decline in my credit score as you can see in the chart above. I later researched and discovered closing an older account actually will hurt you.

Here is why. Your credit history is very important and it accounts for about 15% of your credit score. This shows how long you have had credit. So when you close your older cards, you are making the length of your credit history shorter. In other words, you have removed that frame of time you had, and used, that card from your credit history.

The longer you’ve had a particular credit, the better it helps your credit score look good. There is a better way you can close those old accounts you never use without lowering your scores. I will discuss these in my next post.

I hope these tips have been useful to you and wish you the best as you improve your credit score. I will like to read your thoughts on what other ways you know to raise credit scores, in the comment section below.

See you next time!

Related Posts:

- How to Build Credit with a Secured Credit Card Building credit with a secured credit card is a common…

- How to Build Credit for the First Time Building a credit for the first time may seem daunting…

- How to Improve Your Financial Health Just as it is crucial for your physical health to…

Your entire page is so refreshing and got me excited once again to try to fight off my debt. After divorce I got so depressed and got myself in very deep hole to the point of just wanting to give up but than somehow i got on your page and i have will to get to the bottom of it all. Just wanted to say big thank you for all you do

You are welcome, Tiffany. Thanks for taking the time to read my post, and leaving a comment:) I am glad this helped you find encouragement, and the willpower to tackle your situation. I’m routing for you, and hoping you have a wonderful turnaround in the new year. All the best 🙂